Real estate investment trusts have been one of the outperformers in the stock market rally since March 2009.

The chart of URE, a real estate ETF that consists of mostly commercial REIT versus Standard & Poor 500 Index (S&P500) is self-explanatory.

The same goes for individual REIT such as KFN, CT, DDR, BEE, SPG, CIM, etc. Naysayers have every reason to doubt this bullishness. Think about the sharp increase in delinquency rate, the sharp decline in the occupancy rate and the rent. Think about how desperate the credit market since Lehman collapse. All are solid points and no wonder every other person was talking about commercial real estate would be the next leg down for the economy. But wait a minute. Several indicators have suggested since March that things are getting a lot better in credit markets as we speak. Ted spread measured by the difference between 3-month Treasury bill rate and LIBOR has fallen back to the level of early 2000.

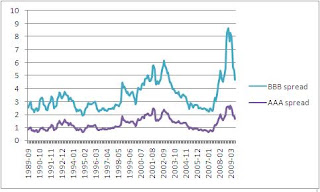

Credit spread measured by the difference between corporate bond yields and 10-year treasury note yield have been narrowed to the level of late 2002 when the last economic recovery began.

Although occupancy rates and rent are expected to be dismal for a while, the credit market has certainly cranked up the REITs. With Public-Private Investment Fund (PPIP) prepared to go into full force by the end of October (four of the nine PPIP funds are funded and ready to go), we have a lot of reasons to believe REITs are the way to go.

Disclaimer: Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author owns DDR, KFN, CT, BEE and URE in her personal account as of September 30,2009.

You may also be interested in articles in the same categories:

http://cocacolabuffet.blogspot.com/search/label/REIT

You may also be interested in articles in the same categories:

http://cocacolabuffet.blogspot.com/search/label/REIT