Whether it is the overly pessimistic downward revised estimates, or the rather sudden subsiding raw material and gasoline prices, or the unusually dry and hot weather, most retailers reported same store sales that beat analysts' estimates.

Luxury and Strong Brand

Leading the way were luxury and strong brand name retailers. Luxury departmental stores such as Neiman Marcus and Saks 5th Ave (SKS), strong brand superstore such as Costco (COST) and women's clothes, Limited Brands (LTD) whose flagship lingerie stores, Victoria's Secrets reaped a 17% rise in same store sales, all reported double digit same store sales growth.

Teenager brands such as Abercrombie and Fitch (ANF), Aeropostle (ARO), American Eagles (AEO) no longer provide monthly same store sales figures while Buckles reported a 10.4% same store sales growth.

ALL GOOD FROM NOW OR JUST AN ADJUSTMENT OVERDONE?

Just a little over a month ago, shares of retailers, especially apparel and shoe makers were beaten down on costs pressure and profit margin squeeze brought by record raw material prices (leather, cotton,etc) and rising gasoline prices that kept shoppers at home.

Commodity and energy prices went through almost a month of correction. International Energy Association (IEA) together with Obama's administration gave energy prices an ultimatum by releasing strategic petroleum reserves,an unusual move given the circumstances but a strong signal of the authorities's determination to stop the energy and commodity rally. The market got the hint. Analysts very soon picked up optimism as gasoline and cotton prices retreated.

However, as many retailers getting ready to hike their products' prices, some as much as 10-15% to pass on higher costs, will the relief in gasoline and raw material prices be enough and in time to score a good report card for retailers in the summer?

Disclosure: The author does not own any of the above mentioned position in her personal account as of July 7, 2011

Showing posts with label Retail. Show all posts

Showing posts with label Retail. Show all posts

Thursday, July 7, 2011

Thursday, June 2, 2011

Same store sales in May mostly disappointed

It's the monthly round-up of same store sales (aka comparable-store sales) again. Same store sales is an important metric of the health of retail businesses. It compares the sales of a store open for at least a year with the figure a year ago. This metric thus excludes sales of new openings and closings.

From Benzinga.com

Costco Wholesale Corp (COST) reported a 13% rise in its May comparable-store sales on Thursday. The retailer's net sales surged 17% to $7.14 billion, from $6.09 billion in the year-ago month. However, analysts expected same-store sales to rise 11.2% for the month. Its same-store sales increased 11% in the US and 21% internationally. Excluding higher gasoline prices and the positive effect of stronger foreign currencies against the US dollar, Costco's same-store sales climbed 7% for the month.

Target Corp (TGT) reported a 2.8% rise in its May same-store sales on Thursday. Analysts were expecting same-store sales to increase 3.5%. Its net sales for the four weeks ended May 28 surged 3.8% to $$4.8 billion.

Dillard's Inc (DDS ) reported a 2% increase in its May same-store sales on Thursday. Dillard's total sales for the four weeks ended May 28 surged 2% to $434.7 million. However, analysts were expecting same-store sales to increase 3.5%.

The Gap Inc (GPS) reported a 4% drop in its May same-store sales. Gap's net sales came in at $1.06 billion, versus $1.05 billion, in the year-ago quarter. Analysts were expecting a 1% fall in comparable sales. Gap North America's comparable sales dropped 4%, while its international same-store sales dipped 9%.

Ross Stores Inc (ROST) reported a 4% rise in its May same-store sales on Thursday. ROST's total sales for the four weeks ended May 28 climbed 8% to $661 million. However, analysts were expecting same-store sales to climb 3.8%.

Nordstrom Inc (JWN) reported a 7.4% rise in its May same-store sales on Thursday. Nordstrom's total retail sales for the four-week period ended May 28 climbed 13% to $796 million. Analysts were expecting same-store sales to increase 5.9%.

Stage Stores Inc (SSI) reported a 1.1% rise in its May same-store sales on Thursday. SSI's May same-store sales surged to $117 million. However, analysts were expecting a 3% rise in same-store sales.

Pier 1 Imports Inc (PIR ) reported a 10.2% surge in its comparable-store sales for the quarter. PIR's total sales climbed 9.5% to $335 million, from $306 million in the year-ago period. The retailer projects its FQ1 net income of $0.11 to $0.12 per share, up from $0.07 per share, in the year-ago quarter. However, analysts expected net income of $0.09 per share for the quarter ended May 29.

Limited Brands Inc (LTD) reported a 6% rise in its May same-store sales on Thursday. Analysts were expecting same-store sales to increase 7%.Its net sales for the four weeks ended May 28 surged to $717.4 million from $657.3 million.

The Buckle Inc (BKE) reported that same-store net sales for May 28 surged 8.8%. Net sales for the four-week fiscal month ended May 28, 2011 increased 12.7 percent to $68.1 million from net sales of $60.4 million for the prior year four-week fiscal month ended May 29, 2010.

The Wet Seal Inc (WTSLA) reported a 2.9% rise in its May comparable store sales.

Kohl's Corporation (KSS) reported a 0.8% rise in its May same-store sales. KSS reported that its total sales increased 2.5 percent for the four-week month ended May 28, 2011.

Rite Aid Corporation (RAD) reported a 1.3% rise in its May same-store sales. However, analysts expected a rise of 1.5%.

Fred's Inc (FRED) reported a 0.2% rise its comparable store sales for the four-week fiscal month of May, which ended May 28, 2011. Fred's total sales for the month increased 1% to $143.5 million from $141.5 million in May 2010.

Saks Incorporated (SKS) reported that owned sales totaled $208.2 million for the four weeks ended May 28, 2011 compared to $177.5 million for the four weeks ended May 29, 2010, a 17.3% increase. Comparable store sales increased 20.2% for the month.

The TJX Companies Inc (TJX) reported May 2011 sales at $1.7 billion, up 7% over the $1.6 billion achieved during the four-week period ended May 29, 2010. Its consolidated comparable store sales increased 2%.

The Bon-Ton Stores Inc (BONT) reported a 2.3% decline in its comparable store sales for the four weeks ended May 28, 2011. Total sales decreased 2.9% to $181.0 million for the four weeks compared with $186.5 million for the prior year period.

From Benzinga.com

Costco Wholesale Corp (COST) reported a 13% rise in its May comparable-store sales on Thursday. The retailer's net sales surged 17% to $7.14 billion, from $6.09 billion in the year-ago month. However, analysts expected same-store sales to rise 11.2% for the month. Its same-store sales increased 11% in the US and 21% internationally. Excluding higher gasoline prices and the positive effect of stronger foreign currencies against the US dollar, Costco's same-store sales climbed 7% for the month.

Target Corp (TGT) reported a 2.8% rise in its May same-store sales on Thursday. Analysts were expecting same-store sales to increase 3.5%. Its net sales for the four weeks ended May 28 surged 3.8% to $$4.8 billion.

Dillard's Inc (DDS ) reported a 2% increase in its May same-store sales on Thursday. Dillard's total sales for the four weeks ended May 28 surged 2% to $434.7 million. However, analysts were expecting same-store sales to increase 3.5%.

The Gap Inc (GPS) reported a 4% drop in its May same-store sales. Gap's net sales came in at $1.06 billion, versus $1.05 billion, in the year-ago quarter. Analysts were expecting a 1% fall in comparable sales. Gap North America's comparable sales dropped 4%, while its international same-store sales dipped 9%.

Ross Stores Inc (ROST) reported a 4% rise in its May same-store sales on Thursday. ROST's total sales for the four weeks ended May 28 climbed 8% to $661 million. However, analysts were expecting same-store sales to climb 3.8%.

Nordstrom Inc (JWN) reported a 7.4% rise in its May same-store sales on Thursday. Nordstrom's total retail sales for the four-week period ended May 28 climbed 13% to $796 million. Analysts were expecting same-store sales to increase 5.9%.

Stage Stores Inc (SSI) reported a 1.1% rise in its May same-store sales on Thursday. SSI's May same-store sales surged to $117 million. However, analysts were expecting a 3% rise in same-store sales.

Pier 1 Imports Inc (PIR ) reported a 10.2% surge in its comparable-store sales for the quarter. PIR's total sales climbed 9.5% to $335 million, from $306 million in the year-ago period. The retailer projects its FQ1 net income of $0.11 to $0.12 per share, up from $0.07 per share, in the year-ago quarter. However, analysts expected net income of $0.09 per share for the quarter ended May 29.

Limited Brands Inc (LTD) reported a 6% rise in its May same-store sales on Thursday. Analysts were expecting same-store sales to increase 7%.Its net sales for the four weeks ended May 28 surged to $717.4 million from $657.3 million.

The Buckle Inc (BKE) reported that same-store net sales for May 28 surged 8.8%. Net sales for the four-week fiscal month ended May 28, 2011 increased 12.7 percent to $68.1 million from net sales of $60.4 million for the prior year four-week fiscal month ended May 29, 2010.

The Wet Seal Inc (WTSLA) reported a 2.9% rise in its May comparable store sales.

Kohl's Corporation (KSS) reported a 0.8% rise in its May same-store sales. KSS reported that its total sales increased 2.5 percent for the four-week month ended May 28, 2011.

Rite Aid Corporation (RAD) reported a 1.3% rise in its May same-store sales. However, analysts expected a rise of 1.5%.

Fred's Inc (FRED) reported a 0.2% rise its comparable store sales for the four-week fiscal month of May, which ended May 28, 2011. Fred's total sales for the month increased 1% to $143.5 million from $141.5 million in May 2010.

Saks Incorporated (SKS) reported that owned sales totaled $208.2 million for the four weeks ended May 28, 2011 compared to $177.5 million for the four weeks ended May 29, 2010, a 17.3% increase. Comparable store sales increased 20.2% for the month.

The TJX Companies Inc (TJX) reported May 2011 sales at $1.7 billion, up 7% over the $1.6 billion achieved during the four-week period ended May 29, 2010. Its consolidated comparable store sales increased 2%.

The Bon-Ton Stores Inc (BONT) reported a 2.3% decline in its comparable store sales for the four weeks ended May 28, 2011. Total sales decreased 2.9% to $181.0 million for the four weeks compared with $186.5 million for the prior year period.

Thursday, May 26, 2011

Family Dollar is Backed by Ackman

In a previous post, Family Dollar (FDO) is briefly mentioned as a retailer that may suffer a cost pinch because it may find difficulty in passing on costs to its relatively lower-end customers. However, the stock is not a good short candidate because it is backed by renowned hedge fund manager Bill Ackman.

In today news, Ackman acknowledged that he had been actively buying shares in FDO, believing a push in the management (implying that he may adopt an activist role) allows the retailer to catch up with its peer, Dollar General (DG). The hedge fund mogul also cites a 70% upside for the shares ($92 dollar per share including dividend. In the meantime, he also views FDO as a potential candidate for leveraged buy-out.

In sum, although I believe that low-end retailers will suffer the most in this round of cost pinch, I would definitely restrain myself from shorting these companies that are backed by strong hands.

In today news, Ackman acknowledged that he had been actively buying shares in FDO, believing a push in the management (implying that he may adopt an activist role) allows the retailer to catch up with its peer, Dollar General (DG). The hedge fund mogul also cites a 70% upside for the shares ($92 dollar per share including dividend. In the meantime, he also views FDO as a potential candidate for leveraged buy-out.

In sum, although I believe that low-end retailers will suffer the most in this round of cost pinch, I would definitely restrain myself from shorting these companies that are backed by strong hands.

Tuesday, May 24, 2011

A Shorts List of Retailers

I rarely write about shorts. As most of you have known, shorting a stock theoretically involves unlimited risks/losses. Therefore, before you even consider using this as a reference, you must have enough trading experiences that will allow you to reverse/mitigate risks should things do not go the way as planned.

The make-up of this list is based on the following assumptions:

1. Retailers are facing increased cost pressure and difficulty to pass on to consumers

2. Gasoline prices stay high into the summer and deter shopping traffic.

3. Risk aversion heightens going into summer.

4. The target price is primarily calculated using the lowest P/E among peers (that I consider as relevant) in the category. E.g. shoes (TBL is the one with the lowest p/e)=15.58. Some adjustments (adding premium) have been made for growth and luxury stocks like LULU, SKS, ANF. As this is based on a standard, methodical calculation, further adjustments should be made based on your research of these companies. For example, there may be substantial risks shorting stocks that may be taken over. Rumors had that ANF may be taken over last November.

If you have doubts about the above assumptions, then you probably should stop here.

Click on the diagram to see a larger view:

The make-up of this list is based on the following assumptions:

1. Retailers are facing increased cost pressure and difficulty to pass on to consumers

2. Gasoline prices stay high into the summer and deter shopping traffic.

3. Risk aversion heightens going into summer.

4. The target price is primarily calculated using the lowest P/E among peers (that I consider as relevant) in the category. E.g. shoes (TBL is the one with the lowest p/e)=15.58. Some adjustments (adding premium) have been made for growth and luxury stocks like LULU, SKS, ANF. As this is based on a standard, methodical calculation, further adjustments should be made based on your research of these companies. For example, there may be substantial risks shorting stocks that may be taken over. Rumors had that ANF may be taken over last November.

If you have doubts about the above assumptions, then you probably should stop here.

Click on the diagram to see a larger view:

Disclaimer: This blog is for general information purpose only. Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author does not have any of the above position in her personal account as of May 23, 2011

ICSC showing temporary slowdown

The International Council of Shopping Centers and Goldman Sachs Retail Chain Store Sales Index dropped 1% in the week ended Saturday from the week before on a seasonally adjusted, comparable-store basis.

"The wettest comparable week in 10 years--combined with cooler temperatures--negatively impacted spending on apparel and other seasonal merchandise," ICSC Chief Economist Michael Niemira said, adding seasonal items may see a bump as consumers gear up for Memorial Day weekend.

On a year-on-year basis, the reading rose 3.1%, easing slightly from the growth posted in the prior week.

For May, ICSC still expects monthly industry retail sales will increase by 3% to 3.5%.

Week Ended Index 1977=100 Yr/Yr Change Weekly Change

21-May-11 512.0 3.1% -1.0%

14-May-11 517.0 3.2% -2.0%

07-May-11 527.6 2.7% 0.0%

30-April-11 527.4 2.8% -0.8%

"The wettest comparable week in 10 years--combined with cooler temperatures--negatively impacted spending on apparel and other seasonal merchandise," ICSC Chief Economist Michael Niemira said, adding seasonal items may see a bump as consumers gear up for Memorial Day weekend.

On a year-on-year basis, the reading rose 3.1%, easing slightly from the growth posted in the prior week.

For May, ICSC still expects monthly industry retail sales will increase by 3% to 3.5%.

Week Ended Index 1977=100 Yr/Yr Change Weekly Change

21-May-11 512.0 3.1% -1.0%

14-May-11 517.0 3.2% -2.0%

07-May-11 527.6 2.7% 0.0%

30-April-11 527.4 2.8% -0.8%

Thursday, May 19, 2011

Retailers feeling the cost pinch

Echoing the previous post, "Retailers the next leg to fall", apparel and shoe retailers continue to feel tremendous cost pressure that they find it hard to pass on to consumers. Many clothing sellers plan to raise prices this summer and fall to make up for higher costs, but there will be limits to how much shoppers will tolerate in a still challenging economy.

Gap's shares (GPS) fell $3.63, or 15.6 percent, to $19.66 in after-hour trading as the company announced a decline in EPS and revenue. Gap now expects to earn $1.40 to $1.50 per share for the year, down from its February forecast for $1.88 to $1.93 per share, citing increased costs. Before Thursday's earnings report, analysts expected $1.84 per share, according to FactSet.

The company claimed that it had to spend 20% more on each item it produced. Other retailers had generally reported 10-15% hikes in cost.

Today, the worse-than-expected results sent shares of Aeropostale (ARO) down $2.04, roughly 10 percent, to $19.32 in after-hours trading. The company cited higher costs and softer sales. This drop in shares was after dropping as much as 16% in early May as the company first warned about cost pressuring margins.

Earlier on, Timberland Co (TBL) saw its shares plunging 32% as it expected margins to shrink this year as the shoemaker battles rising product and labor costs.

As we are getting into the summer, the list of retailer sell-off list may expand as companies, especially low-to-mid end, fail to pass on higher costs to customers. The most vulnerable may be those of the low end such as DLTR, FDO, DG, WMT, COST, TGT, BIG, to name a few, although names like DLTR, FDO, DG may be helped by more thrifty buyers as the economy slows.

For those who do not like the hassles of doing research on individual companies, building short positions in retailer ETF such as XRT into the summer may offer favorable risk/reward profile.

Disclaimer: This blog is for general information purpose only. Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author does not own any of the above positions in her personal account as of May 19, 2011

Gap's shares (GPS) fell $3.63, or 15.6 percent, to $19.66 in after-hour trading as the company announced a decline in EPS and revenue. Gap now expects to earn $1.40 to $1.50 per share for the year, down from its February forecast for $1.88 to $1.93 per share, citing increased costs. Before Thursday's earnings report, analysts expected $1.84 per share, according to FactSet.

The company claimed that it had to spend 20% more on each item it produced. Other retailers had generally reported 10-15% hikes in cost.

Today, the worse-than-expected results sent shares of Aeropostale (ARO) down $2.04, roughly 10 percent, to $19.32 in after-hours trading. The company cited higher costs and softer sales. This drop in shares was after dropping as much as 16% in early May as the company first warned about cost pressuring margins.

Earlier on, Timberland Co (TBL) saw its shares plunging 32% as it expected margins to shrink this year as the shoemaker battles rising product and labor costs.

As we are getting into the summer, the list of retailer sell-off list may expand as companies, especially low-to-mid end, fail to pass on higher costs to customers. The most vulnerable may be those of the low end such as DLTR, FDO, DG, WMT, COST, TGT, BIG, to name a few, although names like DLTR, FDO, DG may be helped by more thrifty buyers as the economy slows.

For those who do not like the hassles of doing research on individual companies, building short positions in retailer ETF such as XRT into the summer may offer favorable risk/reward profile.

Disclaimer: This blog is for general information purpose only. Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author does not own any of the above positions in her personal account as of May 19, 2011

Wednesday, May 18, 2011

Retailers the next leg to fall

Low-to-Mid end stores are reporting more cautious customers, spending on necessities such as food and gasoline and not the others.

From Reuters,

In my opinion, as long as gasoline prices stay close to $4 at the pump, this is going to be a slow and long summer and even fall for many retailers, especially those with very little margin to squeeze such as discounters, supermarkets, low-end department stores as they start to pass on cost increases to customers in the next few months.

Disclaimer: This blog is for general information purpose only. Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author does not have positions in the above stocks in her personal account as of May 18, 2011

From Reuters,

In general, retail earnings looked all right in the quarter ended around April 30, said Kurt Salmon retail strategist John Long, but shoppers were largely absorbing higher costs just on food and gasoline and had yet to face looming increases other goods.

"We're already starting to see a little bit of margin pressure," Long said. "And we think that as we get into the summer and fall, when we see bigger price increases ... that may cause some consumers to pull back."

............................At BJ's, the No. 3 U.S. warehouse club chain, shoppers traded down in both brands and package sizes, Chief Financial Officer Bob Eddy said during a conference call.

............................The U.S. recovery will continue to be slow and uneven, particularly for more moderate-income households, Target (TGT) Chief Executive Gregg Steinhafel said during a conference call.

.............................Wal-Mart Stores Inc (WMT) said its customers were showing pronounced signs of living paycheck-to-paycheck, as sales at its U.S. discount stores open at least a year had fallen for two straight years.

In my opinion, as long as gasoline prices stay close to $4 at the pump, this is going to be a slow and long summer and even fall for many retailers, especially those with very little margin to squeeze such as discounters, supermarkets, low-end department stores as they start to pass on cost increases to customers in the next few months.

Disclaimer: This blog is for general information purpose only. Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author does not have positions in the above stocks in her personal account as of May 18, 2011

Tuesday, September 14, 2010

Retail Sales in August

The most recent retails sales report released by the Department of Commerce suggested that there is no sign of double dip in the economy. The report counts receipts of stores that sell durables and non-durables.

Retail sales in August beat the median forecast of 0.3 percent with components more positive than not. Overall retail sales in August continued to improve, gaining 0.4 percent, following a 0.3 percent rebound in July.

Among the gainers are gasoline station sales (up 1.9 percent), food & beverages (up 1.3 percent) and clothing (up 1.2 percent), health & personal care, sporting goods & hobby stores, general merchandise, nonstore retailers, and food services & drinking places.

Among the losers are 1.1 percent fall in electronics & appliances and a 0.9 percent decline in miscellaneous stores. Motor vehicle & parts dealers decreased 0.7% while furniture & home furnishings slipped 0.5 percent. Building materials and garden equipment sales were flat.

Retail sales in August beat the median forecast of 0.3 percent with components more positive than not. Overall retail sales in August continued to improve, gaining 0.4 percent, following a 0.3 percent rebound in July.

Among the gainers are gasoline station sales (up 1.9 percent), food & beverages (up 1.3 percent) and clothing (up 1.2 percent), health & personal care, sporting goods & hobby stores, general merchandise, nonstore retailers, and food services & drinking places.

Among the losers are 1.1 percent fall in electronics & appliances and a 0.9 percent decline in miscellaneous stores. Motor vehicle & parts dealers decreased 0.7% while furniture & home furnishings slipped 0.5 percent. Building materials and garden equipment sales were flat.

Friday, June 11, 2010

Retail Sales in May 2010

Advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, decreased by 1.2 percent from the previous month, but increased by 6.9 percent from May 2009. Total sales for the March through May 2010 period were up 8.1 percent from the same period a year ago. The figure of April 2010 was revised from an increase of 0.4 percent to 0.6 percent.

Excluding auto and parts, retail sales in May dropped by 1.1 percent from April but it is still 6.2 percent higher than the same period last year.

So, the question here is, " Have consumers finally run out of steam after 7 months of increased retail spending together with fiscal stimuli? "

By looking at each individual category in retail sales, categories that dropped in May from April include auto and parts, building materials and garden equipment and supplies, gasoline stations, clothing and general merchandise (including departmental stores). Among those that increased were furniture, electronics and appliances, food and beverages, healthcare and personal care, non-store retailers.

Building materials and garden equipment and supplies experienced a very sharp drop (9%), that alone could have led to close to 0.6% decline in total retail sales as the category carries about 0.6% of the total. Together with an increase in sales of furniture and electronics/appliances, it seemed to me retail sales in May was disapproportionately affected by homebuilders rushing to build houses to meet the demand of first time home buyer as home buyer credit was drawing to a close at April 30. This was further supported by the fact that this category had a big jumped of 8.4% in April from March following the previous big jump of 7.8% in March from February.

Furthermore, consumer confidence index of June compiled by University of Michigan showed the highest reading of 75.5 in two years. Although consumer confidence index is known to be fickle, it is one of the key leading indicators of future consumer behavior. I guess we will have to wait till June data to confirm whether consumer spending has really come to a halt.

Excluding auto and parts, retail sales in May dropped by 1.1 percent from April but it is still 6.2 percent higher than the same period last year.

So, the question here is, " Have consumers finally run out of steam after 7 months of increased retail spending together with fiscal stimuli? "

By looking at each individual category in retail sales, categories that dropped in May from April include auto and parts, building materials and garden equipment and supplies, gasoline stations, clothing and general merchandise (including departmental stores). Among those that increased were furniture, electronics and appliances, food and beverages, healthcare and personal care, non-store retailers.

Building materials and garden equipment and supplies experienced a very sharp drop (9%), that alone could have led to close to 0.6% decline in total retail sales as the category carries about 0.6% of the total. Together with an increase in sales of furniture and electronics/appliances, it seemed to me retail sales in May was disapproportionately affected by homebuilders rushing to build houses to meet the demand of first time home buyer as home buyer credit was drawing to a close at April 30. This was further supported by the fact that this category had a big jumped of 8.4% in April from March following the previous big jump of 7.8% in March from February.

Furthermore, consumer confidence index of June compiled by University of Michigan showed the highest reading of 75.5 in two years. Although consumer confidence index is known to be fickle, it is one of the key leading indicators of future consumer behavior. I guess we will have to wait till June data to confirm whether consumer spending has really come to a halt.

Thursday, May 27, 2010

Retailers' Outlook in the Second Half

Earnings report cards of retailers so far this year have been upbeat. In the last quarter, about two-thirds of the nation's retailers' earnings topped analysts' expectations, with profits up 26% on average from a year earlier, according to Thomson Reuters.

Their stocks reflected that. Retail stocks have been one of the best performers since the bottom of the financial-meltdown-induced bear market. Many retail stocks had a streak of new 52 week highs until recently, for instance, Steve Madden (SHOO), Aeropostale (ARO), Kohl's (KSS), Autozone (AZO), Macy's (M), Officemax (OMX) to name a few. [Click on the diagram below to enlarge it]

Can this be sustainable? Wall Street analysts seem to think not. They forecast retail-profit growth will slow to 17% in the second and third quarters this year and to 11% in the fourth quarter, according to Thomson Reuters.

Companies are very cautious too. Macy's, Kohl's, Staples that have just reported spectacular earnings offer cautious outlook of the full year.

Some of the concerns cited by analysts and companies include:

1. Tougher comparison --- 2008 and early 2009 were easy beat. Consumer confidence and sales were at historically depressed level. Excess inventory cost a bunch. Companies rushed to slash inventory by giving up profit margins altogether.

2. Expected increase in inventory rebuild and other expenses---As the economy and demand recover, companies have started to rebuild inventory and spending on marketing, technology and capital expenditure. Profits can no longer come from cost cutting as they did in the last few quarters

3. Price hikes in raw materials--- As global economy recovers, so is the price of raw materials. Some retailers like Abercrombie and Fitch (ANF) is already citing rising cotton price eating into the profit margin.

Their stocks reflected that. Retail stocks have been one of the best performers since the bottom of the financial-meltdown-induced bear market. Many retail stocks had a streak of new 52 week highs until recently, for instance, Steve Madden (SHOO), Aeropostale (ARO), Kohl's (KSS), Autozone (AZO), Macy's (M), Officemax (OMX) to name a few. [Click on the diagram below to enlarge it]

Can this be sustainable? Wall Street analysts seem to think not. They forecast retail-profit growth will slow to 17% in the second and third quarters this year and to 11% in the fourth quarter, according to Thomson Reuters.

Companies are very cautious too. Macy's, Kohl's, Staples that have just reported spectacular earnings offer cautious outlook of the full year.

Some of the concerns cited by analysts and companies include:

1. Tougher comparison --- 2008 and early 2009 were easy beat. Consumer confidence and sales were at historically depressed level. Excess inventory cost a bunch. Companies rushed to slash inventory by giving up profit margins altogether.

2. Expected increase in inventory rebuild and other expenses---As the economy and demand recover, companies have started to rebuild inventory and spending on marketing, technology and capital expenditure. Profits can no longer come from cost cutting as they did in the last few quarters

3. Price hikes in raw materials--- As global economy recovers, so is the price of raw materials. Some retailers like Abercrombie and Fitch (ANF) is already citing rising cotton price eating into the profit margin.

Friday, May 21, 2010

Can Aeropostale sustain the momentum?

It is not an overstatement that Aeropostale (ARO) has weathered one of the biggest economic crisis in a century unscathed. While retailer peers fumbled to cut cost, slash inventory, raise cash, deleverage and avoid bankruptcy, ARO was not only surviving but also growing. Yes, you read it right, "growing" !

Its major competitors, Abercrombie and Fitch (ANF), American Eagles (AES), Hot Topics (HOTT) paled before ARO's same store sales, a common metric to measure how a store opened longer than a year fares compared to a year ago. Until recently, ARO stunned analysts with its streak of positive same store sales growth, something that one would be hard pressed to find in the last 12 months.

April 2009 20%

May 2009 19%

June 2009 12%

July 2009 6%

August 2009 9%

September 2009 19%

October 2009 3%

November 2009 7%

December 2009 10%

January 2010 6%

February 2010 7%

March 2010 19%

April 2010 -5%

What makes Aerospotale so good?

Not only was ARO able to maintain traffic to its stores, it was also able to grow its operating margin, attributable as much to pricing power as cost control . The operating margin was 16% in the first quarter, 2010 compared to 13% in prior year.

The management pointed to nimble business models with the right mix of product at the right price. The company integrates designing, sourcing, distribution and marketing all in house, enabling very efficient response to change of fashion trend and demand. However, many analysts pointed to "trading down" among teenagers from higher profile brands like Abercrombie and Fitch as the unemployment rate teetered at almost 10% for the overall population and 25% among teens. Some doubt the sustainability of this success as competitors Abercrombie and Fitch and American Eagles lower prices. Some bet against ARO as teenagers return to brand pursuing as the economy recovers and unemployment pressure subsides, citing potential loss of market share and more need for marketing expenses.

My takes

1. I do not foresee a sharp and quick recovery in the global economy especially with the European debt crisis overshadowing an emerging recovery. Therefore, I believe teenagers will continue to "trade down" at least until 2011.

2. With its expansion of store front, additions of key items, cross selling efforts (e.g accessories) and enhanced marketing initiatives, it may be able to retain a majority of its "trading down" customers even if the economy returns to good times.

3. I was a little concerned by a sudden break of its streak of positive same store sales growth in April. That was the first negative figure in the last 12 months. The management attributed that to an earlier Easter this year that pushed sales forward to March. I generally do not like "calendar" excuse but I think this management deserves benefits of doubt after showing such consistency in delivering spectacular results in a very hard time.

In short, I believe ARO, given its unusually attractive valuation (P/E less than 10 with 2010 earnings estimates compared to its peer's average at 15) and a management that seems to do everything right, can continue to offer favorable risk/reward in the next 12 months.

That said, I am a big believer in the notion that first-hand experience gives best stock selection. I am neither a teenager nor do I have teenager friends. Therefore, I count on you, shoppers, to offer me feedbacks on the sustainability of its appeal to teenagers and kids.

Disclaimer: This blog is for general information purpose only. Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author does NOT own any position of ARO in her personal account as of May 20, 2010

Its major competitors, Abercrombie and Fitch (ANF), American Eagles (AES), Hot Topics (HOTT) paled before ARO's same store sales, a common metric to measure how a store opened longer than a year fares compared to a year ago. Until recently, ARO stunned analysts with its streak of positive same store sales growth, something that one would be hard pressed to find in the last 12 months.

April 2009 20%

May 2009 19%

June 2009 12%

July 2009 6%

August 2009 9%

September 2009 19%

October 2009 3%

November 2009 7%

December 2009 10%

January 2010 6%

February 2010 7%

March 2010 19%

April 2010 -5%

What makes Aerospotale so good?

Not only was ARO able to maintain traffic to its stores, it was also able to grow its operating margin, attributable as much to pricing power as cost control . The operating margin was 16% in the first quarter, 2010 compared to 13% in prior year.

The management pointed to nimble business models with the right mix of product at the right price. The company integrates designing, sourcing, distribution and marketing all in house, enabling very efficient response to change of fashion trend and demand. However, many analysts pointed to "trading down" among teenagers from higher profile brands like Abercrombie and Fitch as the unemployment rate teetered at almost 10% for the overall population and 25% among teens. Some doubt the sustainability of this success as competitors Abercrombie and Fitch and American Eagles lower prices. Some bet against ARO as teenagers return to brand pursuing as the economy recovers and unemployment pressure subsides, citing potential loss of market share and more need for marketing expenses.

My takes

1. I do not foresee a sharp and quick recovery in the global economy especially with the European debt crisis overshadowing an emerging recovery. Therefore, I believe teenagers will continue to "trade down" at least until 2011.

2. With its expansion of store front, additions of key items, cross selling efforts (e.g accessories) and enhanced marketing initiatives, it may be able to retain a majority of its "trading down" customers even if the economy returns to good times.

3. I was a little concerned by a sudden break of its streak of positive same store sales growth in April. That was the first negative figure in the last 12 months. The management attributed that to an earlier Easter this year that pushed sales forward to March. I generally do not like "calendar" excuse but I think this management deserves benefits of doubt after showing such consistency in delivering spectacular results in a very hard time.

In short, I believe ARO, given its unusually attractive valuation (P/E less than 10 with 2010 earnings estimates compared to its peer's average at 15) and a management that seems to do everything right, can continue to offer favorable risk/reward in the next 12 months.

That said, I am a big believer in the notion that first-hand experience gives best stock selection. I am neither a teenager nor do I have teenager friends. Therefore, I count on you, shoppers, to offer me feedbacks on the sustainability of its appeal to teenagers and kids.

Disclaimer: This blog is for general information purpose only. Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author does NOT own any position of ARO in her personal account as of May 20, 2010

Tuesday, November 10, 2009

How many Kindle will be sold?

Since the e-commerce giant, Amazon (AMZN) released its earnings on October 22, 2009, I have been debating with myself whether I should write something about it. Most of my reluctance comes from my inherent resistance to high-tech toys. I have to say I have a good nose for almost everything in fashion except for these gadgets which I dismiss as a guy thing which I , you know, don't wanna barge into. However, I have to admit that Kindle did leave an impression on me at a Xmas party last year when the host's wife proudly showed all female guests her favorite Xmas gift, Kindle. Staring into Kindle held in her hand, the screen itself could easily pass as a "book" to me rather than "a guy thing". Between the Xmas songs, the Xmas tree, the warm blistful crowd, it even appeared to be "friendly" to me.

This "not-a-guy-thing” has caught a spotlight after almost a year. It has become the top selling products on Amazon, not just in the category of electronics but across the board.

The other part of my reluctance to write about it is the likelihood that I am late on board. Spending too much time on a short-lived hype is definitely not my style. After some thinking and research, it strikes me that this may be revolutionary rather than just a hype. So, maybe late, but not too late.

Because Amazon refused to reveal the sales number of Kindle, we can only rely on analysts' estimate for the moment. According to Techflash,

Citigroup's Mark Mahaney now believes that Amazon will sell 1.5 million Kindles this year -- 500,000 higher than his previous estimate. Likewise, he's saying Kindle revenue could jump to $700 million from $550 million.

Mahaney writes in a research note that Amazon's Kindle price cut -- from $299 to $259 -- is "typical" of the ecommerce giant, coming "prior to the market having a viable competitor." He said the price cut "sets up the Kindle for a full runway for Q4" and increases the reader's chances of becoming "one of the hit products of the holiday season."

He estimates that Kindle will sell 2.7 million units and do $1.5 billion in revenue in 2010, roughly 5 percent of Amazon's total revenue. Amazon hasn't revealed any numbers on Kindle sales -- and CEO Jeff Bezos has suggested the company may never give up that information -- so a lot of this is reading tea leaves.

Amazon's big competition in the e-reader market, Sony, is ramping up its advertising ahead of the holiday season. And there's a bunch of other companies are making plans to jump into the fray, including Irex, Asus, and Plastic Logic.

Forrester Research today boosted its projection for total e-reader sales, saying they'll now reach 3 million units in 2009, with 30 percent of sales occurring during the November-December holiday shopping season. That's up 50 percent from Forrester's previous projection of 2 million units in 2009. The research firm said further that e-reader sales could reach beyond 6 million in 2010.

Thursday, November 5, 2009

Retailer October Round-Up

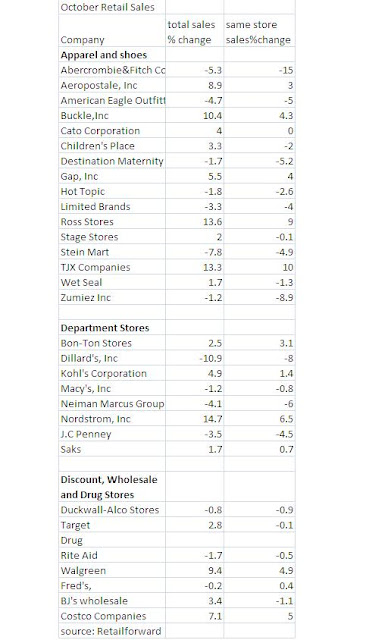

It's that time of the month again when retailers reported their monthly sales. The industry reported October same store sales growth of 1.8%, slightly below analysts' estimates of 2.0% according to Thompson Reuters.

In general, almost all sub-sectors of retailers posted some sales gains from September except for teenage apparel and departmental stores. The following is a snapshot of the % change of same-store sales, an important metric of retailers' performance and the % of total sales [Click on the diagram to enlarge the view].

In general, almost all sub-sectors of retailers posted some sales gains from September except for teenage apparel and departmental stores. The following is a snapshot of the % change of same-store sales, an important metric of retailers' performance and the % of total sales [Click on the diagram to enlarge the view].

Thursday, October 15, 2009

Don't We Just Love Shoes?

I don't know about you. I , for one, am a little tired of all these big banks' earnings this week. Instead of going through numbers of Citigroup and Goldman Sacks that reported earnings today, I turn to off-beat news like" DSW raises outlook as sales improve".

I guess for those who still think it's the end of retail, it's the end of spending, it's the end of capitalism, let's remember what Carries once said when she was purchasing a pregnancy test kit with Miranda.

Carrie: Which kind do I get?

Miranda: Here. This one's on sale -- half-off.

Carrie: I just spent $395 on a pair of open-toed Guccis last week. This is not the place to be frugal.

Disclaimer: Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author does not own any of the above mentioned stocks in her personal account as of October 15,2009

"The company said it now expects earnings of 70 cents to 80 cents per share for its year ending in January, up from a previous forecast of 37 cents to 45 cents per share, issued in August. Excluding one-time items, analysts polled by Thomson Reuters expect a profit of 44 cents per share. This is the second time this year that the company has raised its outlook.Despite the downbeat tone at the end of the news, it did sound a tune of "cautiouly optimistic". The optimism is not just DSW, it's shoes. When you look at the stock of shoes such as SHOO, SKX,NKE,KCP, DECK, almost all of them are not far away from 52-week high with SHOO not too far from all-time-high.

The company said it anticipates sales at stores open at least a year, a key measure of a retailers financial health, will climb 6 percent to 8 percent in the third quarter ending Oct. 31, partly on increased traffic.

The company expects flat full-year sales at stores open at least a year, compared with previous expectations of a mid-single digit decrease.

Despite a strong third-quarter outlook, DSW said it remains cautious about the fourth quarter and believes the economy will remain "challenging."

While top retailers managed a gain in September for the first time in more than a year, analysts said shoppers still expect discounts and bargains. Analysts said that could mean a slow recovery overall for retailers and the economy."

I guess for those who still think it's the end of retail, it's the end of spending, it's the end of capitalism, let's remember what Carries once said when she was purchasing a pregnancy test kit with Miranda.

Carrie: Which kind do I get?

Miranda: Here. This one's on sale -- half-off.

Carrie: I just spent $395 on a pair of open-toed Guccis last week. This is not the place to be frugal.

Disclaimer: Stocks/financial instruments mentioned in this blog are not to be taken as investment advice/recommendation. Readers must consult their own financial advisors and/or consider their own risk/reward profile before making investment/trading decisions. The blog author is not liable for any investment/trading decisions of readers should readers decide to base the decisions on information provided by the blog.

Disclosure: The blog author does not own any of the above mentioned stocks in her personal account as of October 15,2009

Thursday, October 8, 2009

Retailers, X'mas Finally?

U.S. retail sales rose for the first time in 13 month. Based on results from 24 retailers, 16 beat Wall Street estimates, and another six are due to report, according to Thomson Reuters data.

Kohl's

Same-store sales for September increased 5.5 percent over a year ago. The sales figures far exceeded an estimate of a 0.1 percent same-store sales increase, according to analysts surveyed by Thomson Reuters.

Costco

Same-store sales for the period were up 1%, while analysts had expected a 0.6% drop.

BJ's Wholesale Club Inc.

The company said same-store sales fell 0.5% in September, due to a large drop in gas prices. Excluding that, merchandise comparable-store sales rose 5.5%, helped by a shift in pre-holiday sales for Labor Day into the month from August last year. Analysts, on average, had expected overall same-store sales to fall 1%, according to Thomson Reuters

JC Penney

The departmental store saw its sales at stores open 12 months or longer decline 1.4 percent in September, but that was better than the company’s forecast of a three to six percent drop.

Macy

Same-store sales fell 2.3 percent, half as much as analysts anticipated. Its shares rose 2.7 percent to $19.10 in premarket trading.

Neiman Marcus

The upscale retailer saw its same-store sales fall 16.9 percent in the five-week period ending in early October.

Abercrombie

Teen apparel retailer Abercrombie saw same-store sales drop 18 percent, but that was better than the 21 percent decline predicted by analysts. Its shares rose 4.6 percent to $34.15.

Aeropostale

Aeropostale, Inc. reported a 19% jump in same-store sales for September. The results easily surpassed analysts' expectations for an increase of 12.4%

Gap

Gap Inc's sales fell more than anticipated, but its shares rose 3 percent after the company said margins came in significantly above last year.

Limited

Limited, whose chains include Victoria's Secret, posted a 1 percent increase in sales at stores open at least a year. Analysts expected a 2.4 percent decline.

Childern's Place

Children's Place Retail Stores Inc also reported an unexpected 4 percent rise in comparable sales. The results were aided by strong growth online, which the company includes in that figure.

Aeropostale Inc, American Eagle Outfitters Inc and Gymboree Corp raised their quarterly profit forecasts. Still, not all of the gains are coming from stronger sales. Gymboree's optimism stemmed mainly from inventory control and taking fewer markdowns.

Hot Topic

Hot Topic reported a 4% decrease in September, above analysts' expectations of a 6.3% decline.

Zumiez

A specialty retailer of sports-related apparel, footwear and accessories for teens and young adults - reported its same-store sales dropped 0.8% in September, better than Wall Street's projection of a 1% decline. It was Zumiez's smallest decline in over a year.

Walgreen

In-store flu vaccinations helped Walgreen Co (WAG.N), the largest U.S. drugstore chain, post on Friday a better-than-expected 5.3 percent jump in September sales at its stores open at least a year. At Walgreen, pharmacy same-store sales rose 7 percent while same-store sales of general merchandise rose 2 percent.

Analysts, on average, expected a 3 percent rise in overall same-store sales, with pharmacy same-store sales up 4 percent and general merchandise same-store sales up 0.4 percent, according to Thomson Reuters data.

Barnes & Noble

The bookstore is currently in its second quarter, from August 2 to October 31, and expects comparable store sales to drop 1 percent to 3 percent for the period. For its new fiscal year 2010, from May 3 2009 to May 1 2010, it expects same-store sales to fall between 2 percent to 4 percent.

Kohl's

Same-store sales for September increased 5.5 percent over a year ago. The sales figures far exceeded an estimate of a 0.1 percent same-store sales increase, according to analysts surveyed by Thomson Reuters.

Costco

Same-store sales for the period were up 1%, while analysts had expected a 0.6% drop.

BJ's Wholesale Club Inc.

The company said same-store sales fell 0.5% in September, due to a large drop in gas prices. Excluding that, merchandise comparable-store sales rose 5.5%, helped by a shift in pre-holiday sales for Labor Day into the month from August last year. Analysts, on average, had expected overall same-store sales to fall 1%, according to Thomson Reuters

JC Penney

The departmental store saw its sales at stores open 12 months or longer decline 1.4 percent in September, but that was better than the company’s forecast of a three to six percent drop.

Macy

Same-store sales fell 2.3 percent, half as much as analysts anticipated. Its shares rose 2.7 percent to $19.10 in premarket trading.

Neiman Marcus

The upscale retailer saw its same-store sales fall 16.9 percent in the five-week period ending in early October.

Abercrombie

Teen apparel retailer Abercrombie saw same-store sales drop 18 percent, but that was better than the 21 percent decline predicted by analysts. Its shares rose 4.6 percent to $34.15.

Aeropostale

Aeropostale, Inc. reported a 19% jump in same-store sales for September. The results easily surpassed analysts' expectations for an increase of 12.4%

Gap

Gap Inc's sales fell more than anticipated, but its shares rose 3 percent after the company said margins came in significantly above last year.

Limited

Limited, whose chains include Victoria's Secret, posted a 1 percent increase in sales at stores open at least a year. Analysts expected a 2.4 percent decline.

Childern's Place

Children's Place Retail Stores Inc also reported an unexpected 4 percent rise in comparable sales. The results were aided by strong growth online, which the company includes in that figure.

Aeropostale Inc, American Eagle Outfitters Inc and Gymboree Corp raised their quarterly profit forecasts. Still, not all of the gains are coming from stronger sales. Gymboree's optimism stemmed mainly from inventory control and taking fewer markdowns.

Hot Topic

Hot Topic reported a 4% decrease in September, above analysts' expectations of a 6.3% decline.

Zumiez

A specialty retailer of sports-related apparel, footwear and accessories for teens and young adults - reported its same-store sales dropped 0.8% in September, better than Wall Street's projection of a 1% decline. It was Zumiez's smallest decline in over a year.

Walgreen

In-store flu vaccinations helped Walgreen Co (WAG.N), the largest U.S. drugstore chain, post on Friday a better-than-expected 5.3 percent jump in September sales at its stores open at least a year. At Walgreen, pharmacy same-store sales rose 7 percent while same-store sales of general merchandise rose 2 percent.

Analysts, on average, expected a 3 percent rise in overall same-store sales, with pharmacy same-store sales up 4 percent and general merchandise same-store sales up 0.4 percent, according to Thomson Reuters data.

Barnes & Noble

The bookstore is currently in its second quarter, from August 2 to October 31, and expects comparable store sales to drop 1 percent to 3 percent for the period. For its new fiscal year 2010, from May 3 2009 to May 1 2010, it expects same-store sales to fall between 2 percent to 4 percent.

Subscribe to:

Posts (Atom)