Commercial real estates (CRE) have historically been one of the most sensitive to economic conditions and capital availability. With the Fed's two rounds of quantitative easing, recovering businesses and confidence among investors, CRE has been able to utilize leverage to significantly improve return on investment. Real-estate research firm Green Street Advisors reported that its index of Midtown Manhattan office-building values is up 88% since its mid-2009 nadir, back to within 15% of their 2007 peak. The index is tilted toward better quality buildings.

Stock market noted this sharp rise in valuation. Dow Jones Equity All REIT Index has almost tripled since the market's low on March 9, 2009. CRE big names like Vornado Realty Trust (VNO), Boston Property (BXP), Simon Property (SPG), has each almost quardupled its share value in March 2009. However, hints of caution have crept in these waves of euphoria. Big players may have started their way to take some chips off the table.

According to a recent article from Wall Street Journal, high-profile office buildings in large cities have been put on the sell block, including Willis Tower in Chicago, Constitution Center in Washington, the Seagram Building in New York, to name a few.

In April, the total value of new sales listings of U.S. office buildings was $8.7 billion, according to real-estate research firm Real Capital Analytics. That was the highest level since 2008. Preliminary data for May show $10 billion in new listings, which would be the highest monthly total since late 2007.......................................................................

The sharp rise in values has come over the past year, a relatively short time frame in the real-estate market. Recent deals include the sale of 750 Seventh Ave. in New York's Times Square by Hines Interests for a surprisingly high $485 million and Beacon Capital Partners' sale of Market Square in Washington for a record $905 a square foot........

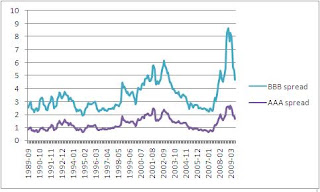

Beacon also is considering bringing to market 1211 Ave. of the Americas in coming weeks, for which the company would look to retrieve well above the $1.5 billion that it paid in 2006, according to people familiar with the matter. The 45-story property houses the headquarters of News Corp., publisher of The Wall Street Journal.This rush to sell is likely to result from worries that there will no longer be easy money, namely easy access to financing. Since April, rallies of high yield corporate bonds and commercial real estates debt came to a halt as yields rose, a sign that lenders now require higher risk premium before they provide the financing. In an article of Wall Street Journal,

Some of the selloff can be attributed to a heavy supply of these bonds, both from the Fed and from companies taking advantage of better market conditions since the crisis. Companies issued a record $114 billion worth of junk bonds through June 2, a 27% increase of the same period last year, according to Standard & Poor's Leveraged Commentary & Data.

"The timing couldn't be worse for the market," said Marina Tukhin, head of asset-backed securities trading at Gleacher Descap in New York, referring to the effect of the Fed's auctions on the mortgage market, which she calls "oversaturated" with troubled assets.

Meanwhile, other measures that gauge the ease of obtaining financing or risk attitude, such as TED spread (the difference between LIBOR and treasury securities yield) has remained quite subdued although its current level is much higher than the one in March. Fundamental wise, most REITs are showing growth in net operating income (NOI) and funds from operations (FFO) which measure strengths in CRE companies.

That said, for those who anticipate no more quantitative easing and a slowdown in the eocnomy, gradually building shorts position in REITs into the summer should provide fairly handsome risk/reward profiles.