Year 2011 is the year before a president faces re-election, the year after a president has lost control of Congress and the second year of a fragile economic expansion.

THE YEAR BEFORE A PRESIDENT RUNS FOR ELECTION:

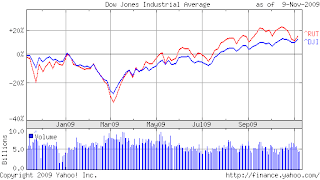

Since 1945, the Dow Jones industrial average has gained an average of 19 percent the year before a sitting president runs. That's more than double the 7.9 percent average annual gain during the same period. If you take out the 10 years when the president was running, the average gain drops to only 5.8 percent...................................................

THE YEAR AFTER A PRESIDENT LOSES CONTROL OF CONGRESS

Presidents whose party controlled both houses of Congress have lost at least one chamber five times in the past 80 years. Stock returns in the following year haven't followed a pattern. The Dow plunged 53 percent in 1931 and gained 34 percent in 1995. Gains in the other three years ranged from 2.2 percent to 20.8 percent. That makes it impossible to forecast what will happen this time. The change in Congress in 1931 came during the Great Depression, while the 1995 transition came during the first part of the Internet boom. The next Congress faces a fragile economic period, which could mean that the market offers another single-digit gain like this year.

Gridlock hasn't been great for stocks. Since 1945, the Standard and Poor's 500 index has gained 4 percent in years when Congress was split between parties. It increased 8 percent when Congress was controlled by one party and the White House another. When a single party was in control of Washington, the index gained an average of 11 percent.

SLOW-GROWING ECONOMYAccording to Clearbridgeadvisors.com,

..................................................................................................................

.....................Stocks have been in a bull market for 18 months, pushing the Dow up 70 percent since it hit a 12-year low in March 2009. That gain is larger than normal but isn't surprising considering that the rally followed the worst financial crisis since the Great Depression. During slow recoveries like this one, bull markets typically last 30 months and bring gains of 44 percent overall, according to Ned Davis Research.

"......Subsequent to 17 mid-term elections since 1942, the S&P 500 appreciated 17 times (100% batting average) over the next 200 days, with the average return being 18.3%. The low percentage gain (+3.9%) was in 1946, just after World War II ended and deflation fears were in vogue, and more recently the 6.1% gain for the S&P 500 after the 2006 mid-term elections....."In the same report, MKM Partners and the Leuthold Group both suggest bull market ahead. MKM Partners pointed out that stock valuation are more attraction than bond. The earning yield of companies , which is earnings divided by stock price is 3 percent higher than bond yield, the highest since 1951, the administration of President Truman. The Leuthold Group, by studying the relationship between P/E during the midterm election and the following 10-year stock return, suggests that the 10-year-annualized return following 2010 election will be 11%.

All in all, without digging into the "Why's", descriptive statistics generally lean toward a bull market following this midterm election.